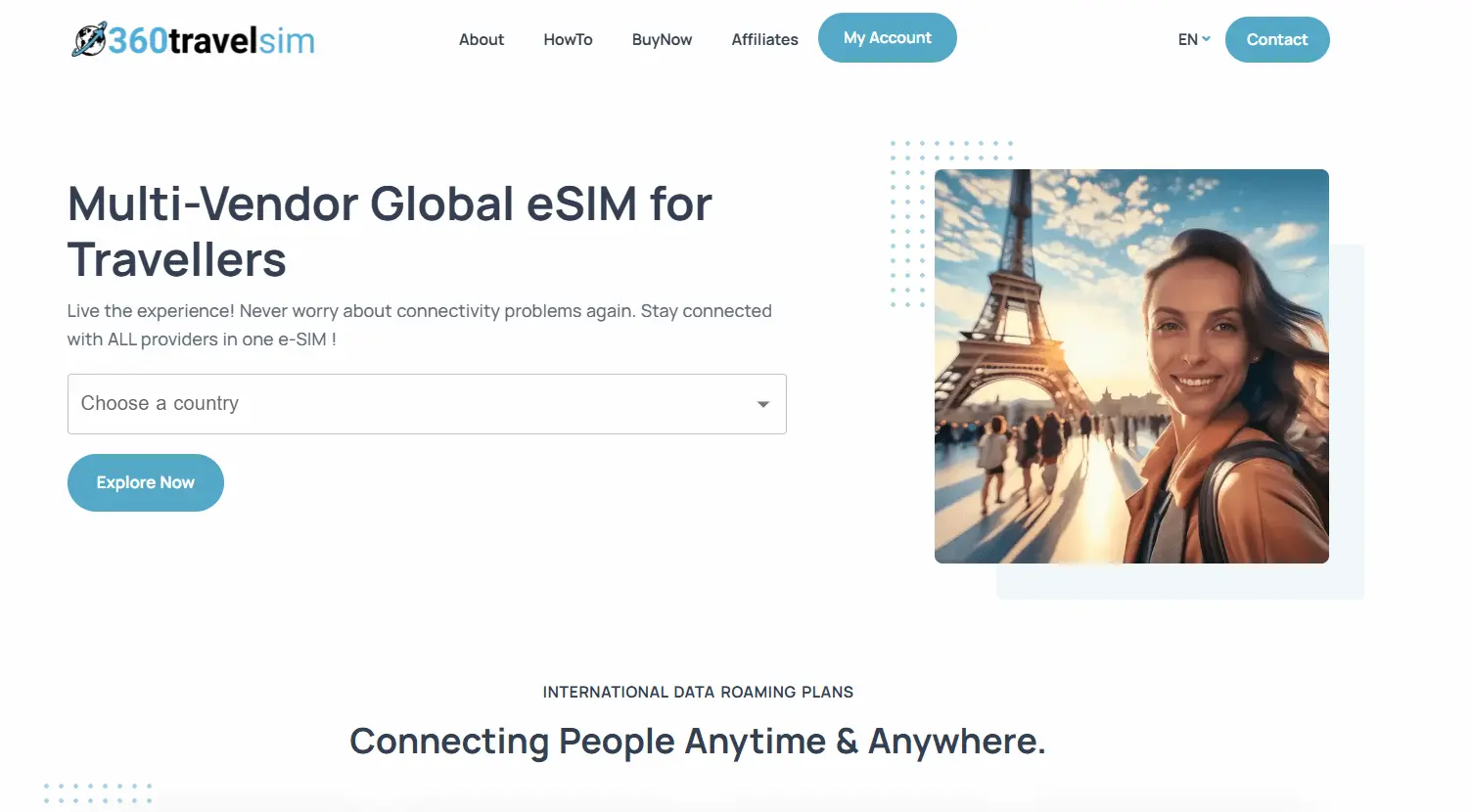

Overview

This case study explores the development of a comprehensive eSIM platform that enables users to purchase and manage eSIMs for global travel. The platform includes a Next.js frontend with SEO optimization, a Golang REST API backend, a MyAccount CRM, a Resellers CRM, and integrations with Stripe and TRC20 USDT for payments. The system also includes Google, Facebook, and Org tracking for analytics and marketing.

Business Challenge

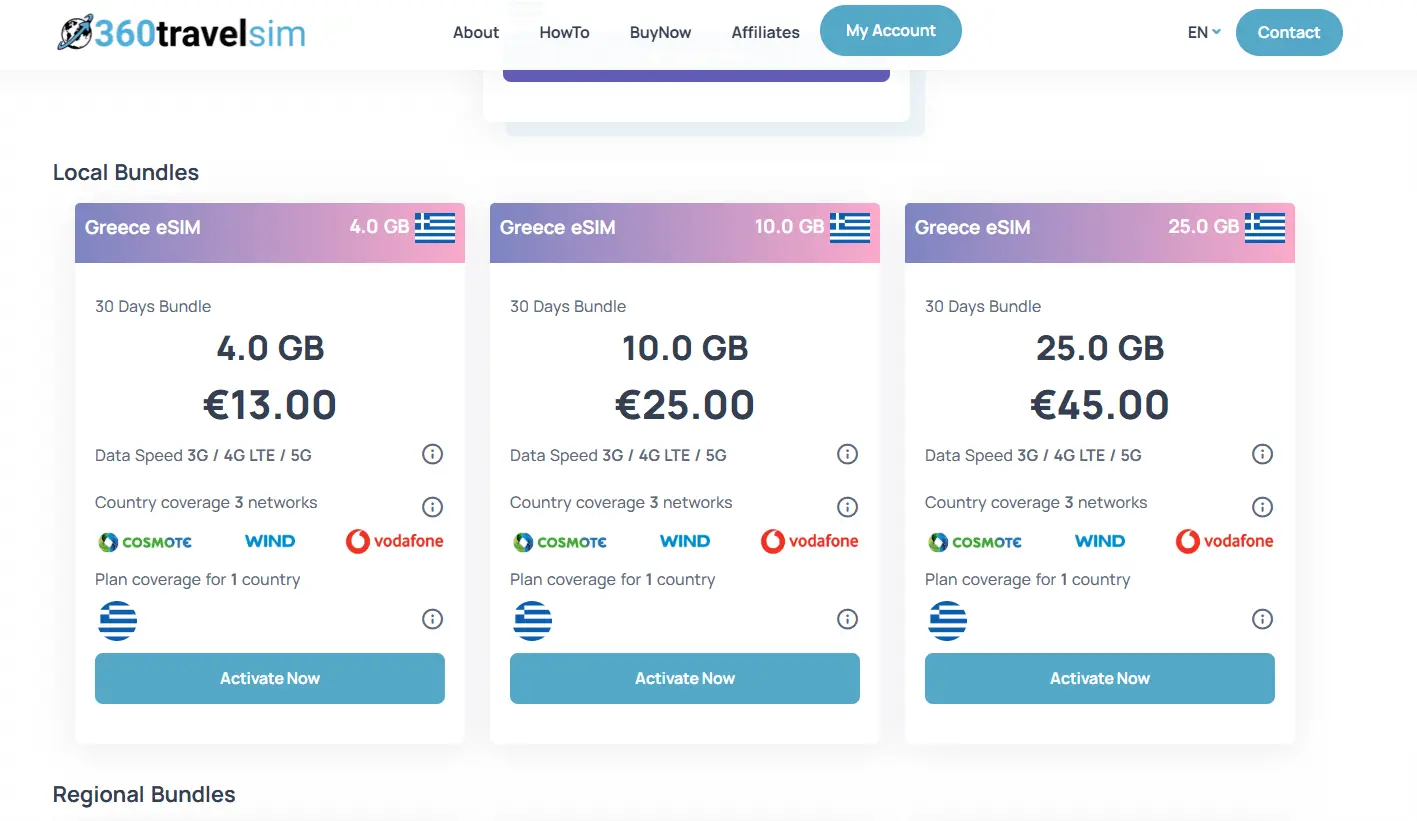

The client needed a scalable eSIM platform that could:

- Provide a seamless user experience for purchasing and activating eSIMs.

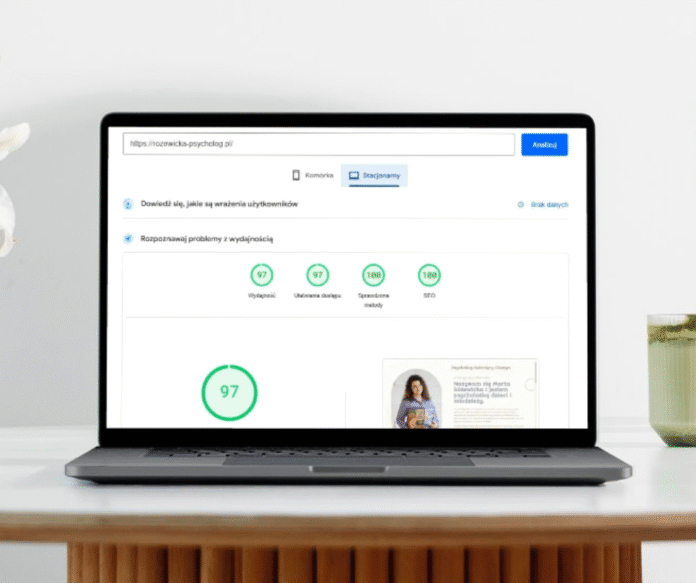

- Support SEO optimization for organic traffic growth.

- Allow resellers to manage their customers and commissions.

- Offer multiple payment options (Stripe for fiat, TRC20 USDT for crypto).

- Track user behavior with Google Analytics, Facebook Pixel, and custom Org schema.

- Ensure high performance and security for transactions.

Solution Architecture

1. Frontend: Next.js with SEO & Tracking

- Framework: Next.js (React-based) for SSR (Server-Side Rendering) and SEO optimization.

- SEO Schema: Structured data (Org schema) for better search engine visibility.

- Tracking Integrations:

- Google Analytics & Tag Manager for user behavior tracking.

- Facebook Pixel for ad retargeting.

- Custom event tracking for conversions.

- Dynamic Product Pages: Optimized for search engines with metadata, OpenGraph, and JSON-LD.

2. Backend: Golang REST API

- Language: Golang (for high performance and concurrency).

- API Design: RESTful architecture with JWT authentication.

- Key Features:

- User authentication & profile management.

- eSIM inventory management.

- Order processing & payment validation.

- Webhook integrations (Stripe, USDT blockchain monitoring).

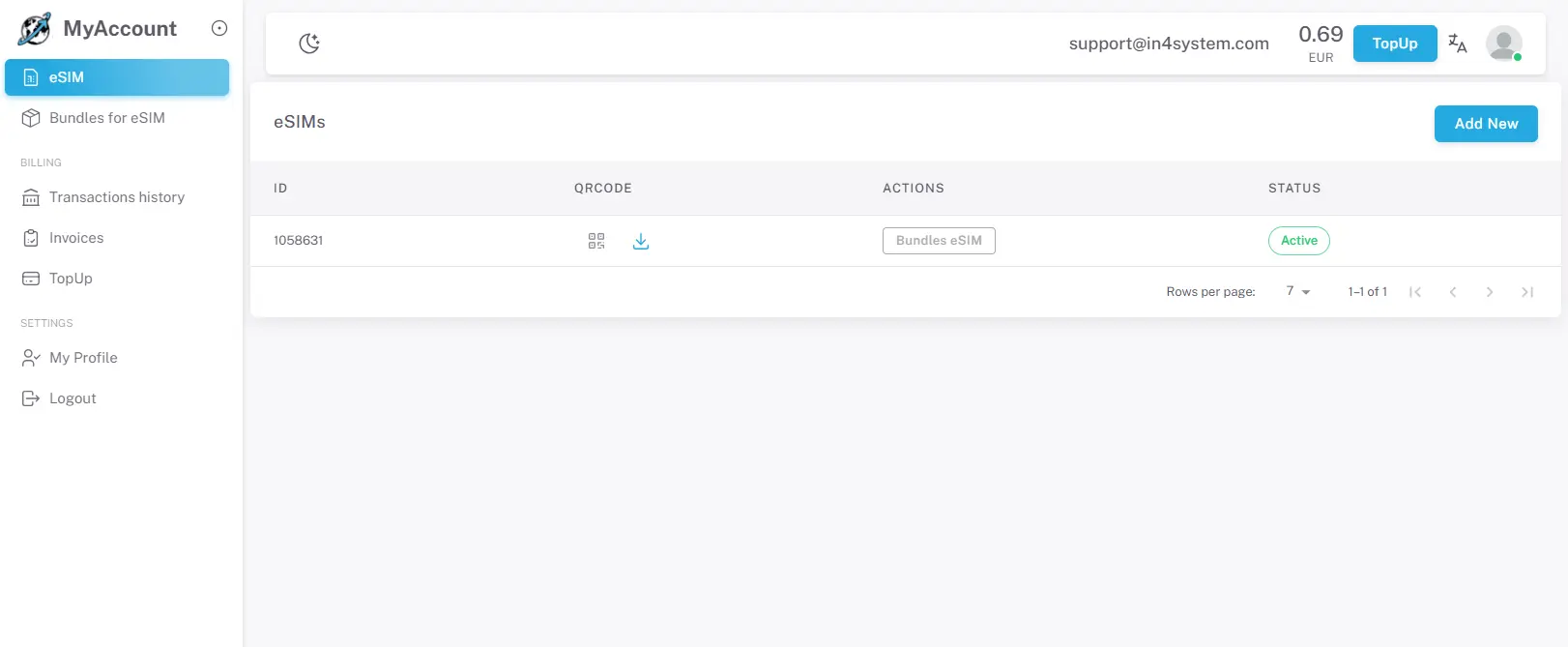

3. MyAccount CRM (Next.js)

- Self-service portal for users to:

- Purchase new eSIMs.

- Track active eSIMs.

- View transaction history.

- Update payment methods (Stripe/USDT).

4. Resellers CRM (Next.js)

- Dashboard for resellers to:

- Manage their customers.

- Track commissions.

- Generate referral links.

- Withdraw earnings (Stripe/USDT).

5. Payment Gateways

- Stripe Integration:

- Credit/debit card processing.

- Subscription management (for recurring plans).

- TRC20 USDT (Crypto Payments):

- Blockchain transaction validation.

- Automatic balance updates upon confirmation.

6. Security & Compliance

- Data Encryption: TLS 1.3 for API communications.

- Fraud Prevention: Stripe Radar for fiat payments.

- Crypto Security: Multi-signature wallet for USDT transactions.